td ameritrade taxes on gains

Is required by federal andor state statutes to withhold a percentage of your IRA distribution for. Long-term gains on assets held for more than a.

Ad Refine Your Retirement Strategy with Innovative Tools and Calculators.

. ETNs are the most tax-efficient and well-understood investment vehicles for gaining commodity exposure. Form 1099 OID - Original Issue Discount. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

We suggest that you seek the advice of a tax-planning professional with regard to your. Because you are taxed only. Ad Delivering results expertise and proactive client service for International Tax Advisory.

Gains will be taxed as short-term capital gains. I recently opened an account with TD Ameritrade. Ad Refine Your Retirement Strategy with Innovative Tools and Calculators.

In other cases TD Ameritrade Clearing Inc. And foreign corporations capital gains. You must enter the gain or.

Discount bonds may be subject to capital gains tax. If you sell stock at a gain it triggers a taxable event. Find a Dedicated Financial Advisor Now.

TD Ameritrade does not provide tax advice. Take Advantage of Potential Tax Benefits When You Open a TD Ameritrade IRA Today. If you hold covered securities with tax-exempt original issue discount OID it will now be reported to the IRS on Form 1099-OID.

Do I need to report anything on my tax return if I havent withdrawn any funds from the account. Depending on your activity and portfolio you may get your form earlier. I have a TD Ameritrade account and i have capital short term gain of 30000000 and a Short term loss of 24000000.

Capital gains on assets held for one year or less are considered short-term gains and are taxed at an individuals ordinary tax rate up to 35. Ordinary dividends of 10 or more from US. Make the World Your Marketplace With Aprios International Tax Planning Services Today.

Am i to pay taxes on the 6000000. Or the short term gain of. The IRS could care less what you do with your profits so long as they get their cut come February.

Does TD Ameritrade take taxes. Do Your Investments Align with Your Goals. Take Advantage of Potential Tax Benefits When You Open a TD Ameritrade IRA Today.

Dfv Got A Shout Out On Td Ameritrade The Article Is Right Though I Got 100 Of My Portfolio In Gme And I M Still Holding R Gme

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Capital Loss Deduction Tax Season Basics For Investors Ticker Tape

Here S How To Minimize Taxes When Investing Youtube

Tax Bite Capital Gains Short Term And Long Term Inv Ticker Tape

2022 Td Ameritrade Review Pros Cons Benzinga

1099 Just Doesn T Make Sense R Tdameritrade

How To Report Section 1256 Contracts Tastyworks

Traders And Taxes Special Tax Treatment For Special Ticker Tape

Investors Shrug Off Higher Taxes For Good Reason The Colony Group

2022 Td Ameritrade Review Pros Cons Benzinga

Taxes On Stocks How Do They Work Forbes Advisor

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Thinkorswim Review 2021 Fees Services More Smartasset

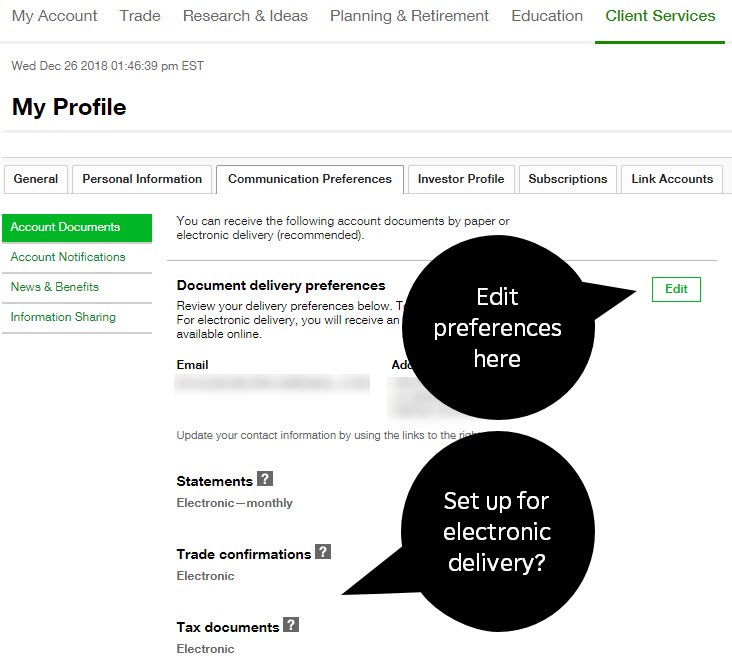

Go Paperless This Tax Season Electronic Tax Forms Fr Ticker Tape

Tax Loss Harvesting Capital Loss Deduction Td Ameritrade

Investing And Taxes What Beginners Need To Know The Ascent

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape